Do you think that there is even a slight chance for bankruptcy in your case?

For all individuals, it is important to have clear insight regarding the factors that can actively contribute to a bankruptcy because there may be numerous causes of debt that can promote the chances of bankruptcy.

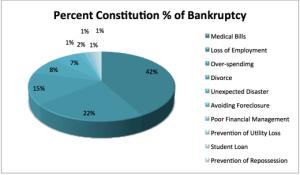

Here, we will discuss the factors that are directly linked to bankruptcy with their accurate percent value.

This pie chart is very helpful in extracting a visual understanding of the factors leading to bankruptcy. If these factors are controlled, the chances of bankruptcy become slim or come close to none.

Medical Bills

Medical bills constitute 42% of all bankruptcy cases as majority of the population is medically uninsured and they are not able to afford their medical bills, leading to the increased chance of personal bankruptcy.

Losing Employment

Losing your job can be very hard on the mind as well as on the pocket. It can boost the feeling of nothingness and depression. It is also directly associated with the chances of going bankrupt, if an individual is not careful with his earnings, funds and savings.

Expenses

Expenses and overspending is considered to be one of the most common causes of bankruptcy. If an individual spends more than they earn, they will ultimately face the consequences in the form of a bankruptcy.

It is therefore, essential to control the urge to spend money, especially in the form of credit that must be repaid later. As the chart shows, 15% of all bankruptcy incidents are due to the uncontrollable urge to spend money.

Divorce

Divorce constitutes 8% to bankruptcy occurrences as it is a complicated process. The division of finances and property can leads toward the possibility of bankruptcy, because you will have lesser assets to clear your bills.

Credit Cards

Today’s world uses and prefers plastic money over cash and as it’s easy to utilize credit cards for the payment of the bills, many people choose to do so. However, the piling debt on your credit card is almost impossible to pay off as the interest charges keep increasing. 1% of all bankruptcies occur due to the failure of timely payments of credit card debts.

Credit cards gradually increase the total debt amount to a certain extent and when an individual fails to return it, it will ultimately force them to claim a bankruptcy. It is ideal to utilize debit cards if you wish to carry plastic money, so that you only spend money that you can afford and no more.

For the prevention of bankruptcy, it is always advisable to consider other earning sources to boost the income. In case of loans, try to return them on a timely basis, otherwise they can become a financial burden and ultimately lead towards bankruptcy.

If you are suffering from the consequences of these factors and want advice about bankruptcy, our legal advisers can help you within West Palm Beach, FL. Contact us now at 561.689.1512