Walker Law Firm – Debt Relief

Debt is a major problem faced by businesses and individuals when the economy is down and people start losing their jobs. Debt Relief refers to complete or partial absolution of debt. Debt relief helps stopping the increment of personal, corporate, or national debts. Paying your bills and feeding your family at the same time could be a challenging task if your income is lower than the bills.

Therefore, there are two ways you can get debt relief:

- Debt Consolidation

- Bankruptcy

Debt Consolidation

Debt Consolidation rearranges various debt payments into one payment. It can be done through two kinds of loans:

- Secure Loans

- Unsecured Loans

A debt consolidation may end up costing you more. Even though it has low interest rates and monthly payments, paying for a longer time period will become expensive. Another drawback is that you would have to pay taxes on the money you saved after paying debt relieves. The reason is that the saved money is considered as income by the Internal Revenue Service (IRS). The creditors inform IRS to settle the debt which is regarded as income.

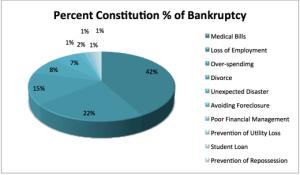

Bankruptcy

Bankruptcy can be filed when you are unable to repay money to the creditors. It will provide you automatic stay protection which will forbid creditors from money collecting behaviors including: emailing, harassing phone calls, retrieving money or even filing lawsuits against you.

Bankruptcy will help you remove unsecured debts, for example: credit cards and medical bills. It can be settled through Chapter 7 or Chapter 11. There are no interest rates as long as you are able to complete it.

It also minimizes the exposure to any kind of lawsuit. Through bankruptcy, the payback can be done as early as 90 days and as late as 5 years which gives you a broader range of choice. It also doesn’t charge you with numerous interest rates for exceeding the time period of repayment. There will be no uncertainty about the amount you are paying, unlike debt consolidation; you will be given a fix sum to pay.

The success rate of bankruptcy chapter 7 is 100%. It protects your insurance policy and pension plan so that you don’t face difficulty after the payment is done. It also provides you the option to let your cosigner pay for your debt.

West Palm Beach is a business centre whose major industries include tourism and technology. Many businesses have considered Palm Beach for their business headquarters which has increased the job opportunities for people.

However, as the economy continues fall and people start losing their jobs, their debt will start to pile up. Job or not, you still have bills to pay and a family to feed. Debt Relief is the best option to deal with severe debt situations and start off fresh. If you are looking for Debt relief through bankruptcy, you can contact Walker Law firm at 561.689.1512.